The Term Sheet

WHY A TERM SHEET IS IMPORTANT WHEN INVESTING IN A START-UP

Investing in a start-up can be a complex process during which it is important to weigh up all the risk factors and make the investment secure. The interests of the investor and those of the start-up should be taken into account in an appropriate balance, thus it makes sense to formulate and agree on the framework conditions of the investment before starting negotiations on the investment agreement.

A term sheet can be used as such a framework agreement. This article explains what a term sheet is, what exactly it is used for and what a meaningful term sheet should contain.

What is a term sheet and what is it needed for?

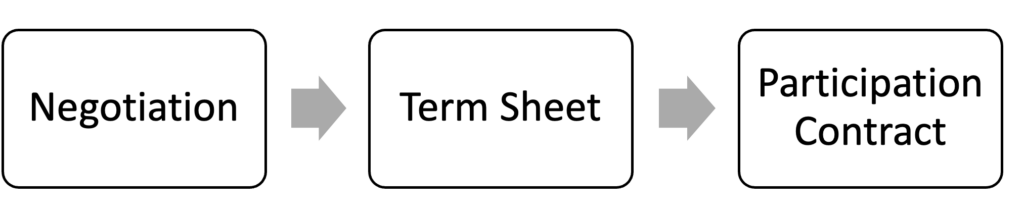

The term sheet is a central component of the process of investing in a start-up and a framework agreement between the start-up and the investor that is used as the basis for the investment and the preceding negotiations.

The term sheet is thus a basic document that contains the most important key points of a planned investment, important conditions, future terms and the ideas of the parties and serves as a binding basis for the design of the future participation agreement. The term sheet therefore serves to provide the parties with planning security and ensures that the parties’ contract negotiations and discussions are conducted in accordance with the conditions and principles described herein. Although the term sheet does not legally oblige the parties to conclude an investment contract, the clauses and principles formulated in the term sheet are binding.

The term sheet provides the parties to the planned investment with a structured overview of the desired course of the investment and any possible scheduling. It serves as an initial basis for clauses, rules and conditions and is intended to accelerate lengthy contract negotiations.

What can and should be regulated in a term sheet?

A term sheet has no substantive limits, so that the parties are initially free in terms of content. It can therefore cover everything from ideas and wishes regarding the investment, to the course of the investment, to the investor’s exit. All the key points for the parties can thus be included in the term sheet.

However, a term sheet should always include the time frame for the planned investment negotiations, the amount of financing and the investor’s stake, the use of funds, guarantees for the investor, the start-up’s valuation method, an exit clause and a confidentiality agreement.

A good term sheet is characterised by a specific and concise regulation of the most important cornerstones of the planned investment. While it should cover all the necessary points, the document should not be ‘overloaded’.

The valuation of the start-up as the central question

The valuation of the start-up is one of the main points to be negotiated in a term sheet. This is due to the valuation being the basis for determining the amount in which the investor will participate. The higher a company is valued, the less the founders’ participation rate decreases for a certain investment amount.

Since a start-up usually does not yet have a lot of reliable financial data, the valuation of a start-up is mainly based on future, forecast developments and on the potential demand for the start-up’s product on the market. For such a forecast, it is crucial, for example, whether there are many competing companies developing similar products, whether the product is likely to appeal to a wide range of customers and how the general future economic situation is generally assessed.

We would be happy to advise and support you with our expertise in planning and creating a term sheet of this kind.